LeadersIn Africa Summit 2024 - Post Event Report

The LeadersIn Africa Summit 2024, held on November 11th in Cape Town, South Africa, brought together top industry leaders to network and explore key topics such as digital transformation, fintech growth, and AI development in Africa. Sponsored by HPE and Detecon, the event featured diverse formats, including panels and roundtable discussions under Chatham House Rules, with significant participation from C-level executives across 17 industry sectors. This comprehensive post-event report, curated by Omdia, highlights the evolving strategies of African telcos, the rapid expansion of mobile financial services, and the challenges and opportunities within Africa’s emerging AI ecosystem.

Summary

The Africa Tech Festival LeadersIn Africa Summit 2024 took place on 11th November 2024 in Cape Town, South Africa. According to Chika Ekeji, Group Chief Strategy and Transformation Officer, MTN, “the LeadersIn event provided a great opportunity to network and share perspectives with a wide range of industry practitioners from around the continent. “

HPE and Detecon were this year’s sponsors. The Summit offered various formats of discussions such as presentations, panel discussions, and roundtable sessions. Run under Chatham House Rules, this year’s roundtables were attended by influential CXOs of various corporations such as MTN, FNB South Africa, FirstBank Nigeria. Discussed topics included Fostering the Digital Transformation Journey and the Future of Industries, Driving Connectivity Interoperability in Africa, Maximizing Opportunities for Fintech, Emerging Technologies Spearheading the Future of Industries, Getting the best out of AI, Impact of ESG on a digitally transformed Africa and Regulatory Frameworks.

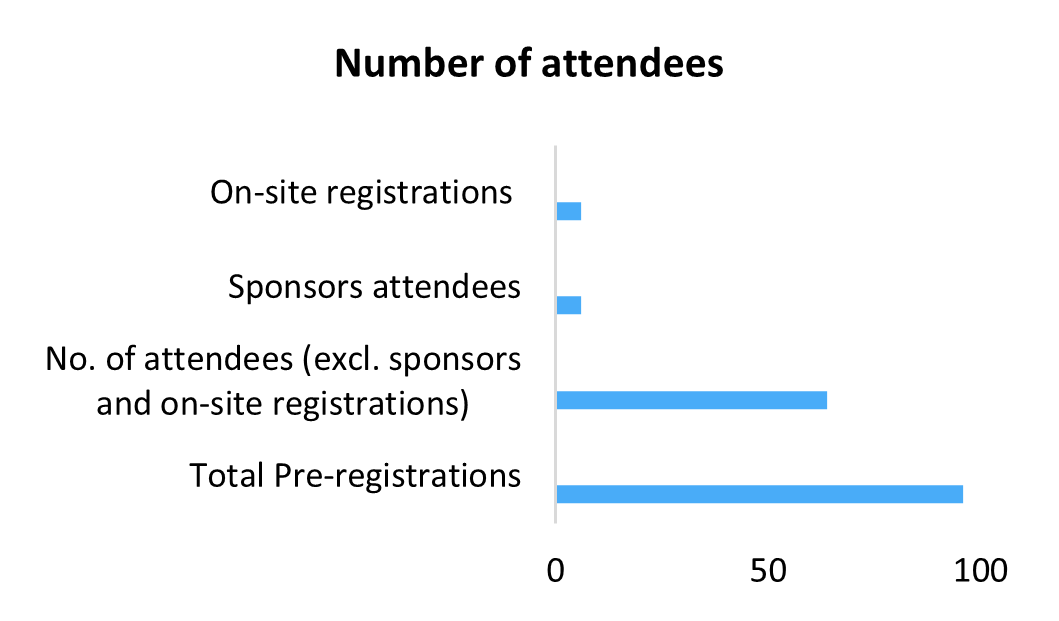

Attendance was impressive with 76 attendees. 96 guests were pre-registered, which brings the retention are at 79%.

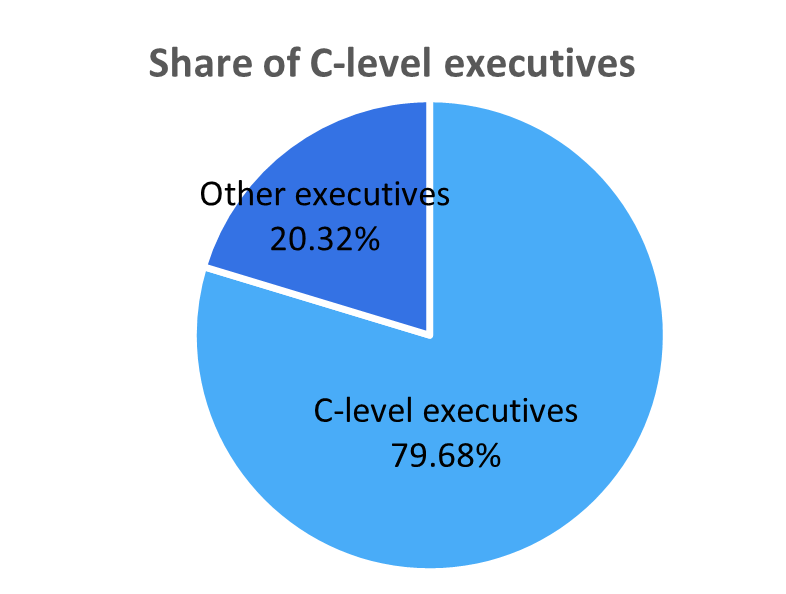

Representation from 17 different industry verticals, with the largest representation from Telecom Operators, Banking/ Finance and Government. Other industries included: Automotive, Broadcasting, Charity, Education, Energy & Utilities, Healthcare, Investor/ VCs, Media, Mining, Regulatory, Retail/FMCG, Supply Chain/Logistics, Technology Solutions, Travel & Leisure. 79.68% of the audience were C-Level executives from large enterprises.

Digital transformation at the heart of CSPs strategies

Digital transformation is at the heart of all African telcos strategy and is key to improve CSPs service delivery as well as consumers and businesses experience. The trend has accelerated from 2020, during the COVID-19 pandemic. CSPs are increasing partnerships with third parties to sustain digital transformation and innovation. They also invest in latest broadband technologies and digital IT systems to support their plans.

In 2021, MTN group launched its Ambition 2025 strategy, aiming to transform from telco into a platformCo with Fintech and digital services as the core services. Ambition 2025 has 4 key priorities including building the largest and most valuable platforms, creating shared value and accelerating portfolio transformation. In order to build valuable platforms, MTN will focus on 5 pillars: Fintech (MoMo), Ayoba SuperApp, Enterprise services, Network as a service, and APIs.

In 2021, Vodacom launched its Tech 2025 digital transformation strategy, in line with Vodafone group’s strategy. Vodacom planned to leverage scaled platforms to deliver customer value and drive new revenue growth. Through digital transformation, Vodacom aims to drive the evolution of mobile and fixed network access, transport network simplification and telco cloud, with a specific focus on making the network smarter through automation and artificial intelligence. Flexible modern digital IT architecture will provide improved customer experience. On a business side, the strategy that places IT at the center of business transformation and is set to make it 50% faster for Vodacom to launch new products and services and easier to create new platforms in-house.

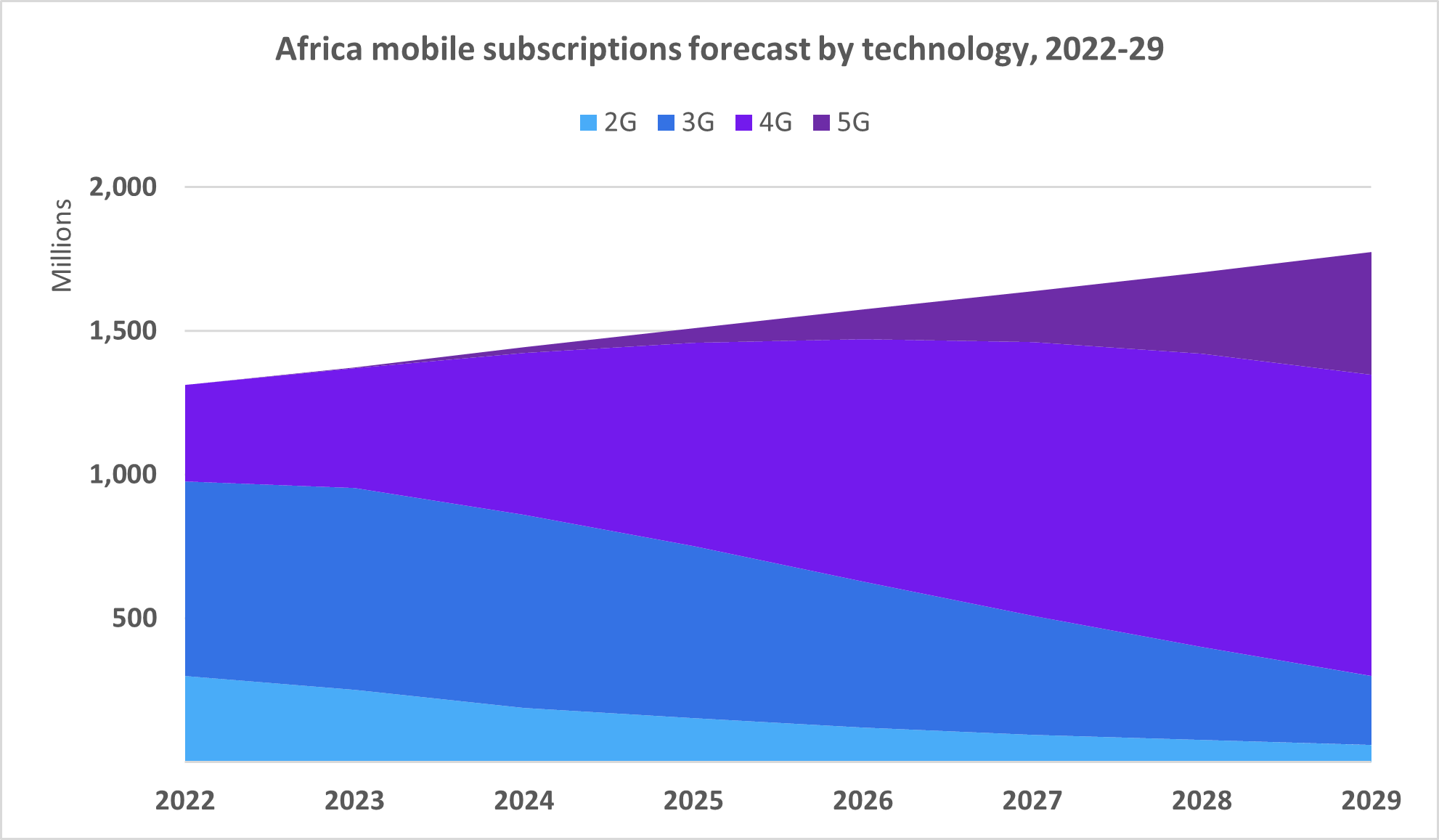

To sustain their digital transformation strategies, African CSPs also invested a lot in broadband recently, leading to a surge in fixed wireless access (FWA) over 4G and, since 2022, 5G. At the same time, investments in fiber is on the rise in key markets. Omdia forecast fixed broadband household penetration rate to grow from 13% in 2024 to 16% in 2029. In the mobile segment, the share of 4G users will grow from 39% in 2024 to 59% in 2029, while the share of 5G users will grow from 1% in 2024 to 24% in 2029.

CSPs put much efforts in digital transformation but governments must also play their parts. Slow regulatory processes and policies implementation often hold back development meant to boost digital transformation. This is the case, for instance, for the broadcasting digital switchover which is yet to be complete in many African markets.

Maximising Opportunities for Fintech

The number of Fintech companies in Africa has boomed since 2020, with a focus on mobile money, digital payments, remittances, digital lending, airtime advance, insurance.

According to Omdia research, 123 of Africa’s 174 mobile networks ran mobile money platforms in 3Q24. Mobile financial services (MFS) is one of the fastest growing segment with over 485 million users in 2024, representing 34% of the 1.4 billion Africa mobile subscriptions. Omdia forecasts that the number of MFS subscriptions will exceed 800 million by 2029.Key drivers include low banking penetration rates, digital transformation (as more everyday life activities are done online), an increasing need to transact remotely (which was accelerated during the COVID-19 pandemic), new services beyond P2P transfer such as payments and airtime purchase.

There are disparities across the region. East Africa leads in terms of subscriptions and penetration rate. In 2023, East Africa hosted 41% of the continent’s MFS users. The subregion pioneered the service at a large scale in Africa with Safaricom Kenya’s M-PESA service. The region also has the highest usage rate, with 56% of mobile users transacting via MFS in 2023. Omdia expects this ratio to grow to 61% by 2028. Over the past year, growth has been fueled by strong performances in Ethiopia and Nigeria, where MFS were launched more recently. North Africa has the lowest MFS penetration rate over the next five years as the service is yet to be launched in Algeria and due to higher banking penetration. The service is however growing fast in Egypt, on the back of strong performances from Vodafone’s platform. In Southern Africa, telcos fintech services are taking off despite higher banking penetration rates. The growth is driven by the incorporation of MFS into wider fintech digital platforms.

Despite steady growth, consumers still don’t make most of MFS. Most subscribers essentially use MFS for P2P funds transfers due to low awareness of financial services available and/or low disposable income to afford other services. Omdia forecasts that this trend will remain similar until at least end of 2025 as service providers are still settling in and campaigning to promote non-funds transfer services.

Payments to merchants and utility bill payments have the highest potential for now as they can work on USSD platforms. E-commerce, on the other hand, requires smartphone usage and broadband connectivity. As of 3Q24, 3G was still Africa’s dominant technology with a 47% share of the country’s mobile subscriptions. 4G usage is however expected to become dominant in 2025.

On the regulation side, the environment is improving as the authorities figured out how to regulate a service which was initially perceived as hybrid between sitting in both financial and technology sectors. Fintech is regulated by financial regulators, which either issue payment licenses to CSPs or oversee partnerships with banks and other financial institutions. Regulatory challenges however remain and include slower uptake in the Central African region, where rules are often tighter, inadequate KYC processes, lack of dedicated fintech regulation framework, unplanned taxation, which CSPs pass on to subscribers.

AI ecosystem slowly taking shape in Africa

The African AI ecosystem is slowing taking shape. AI can enhance financial inclusion, job creation and public service delivery and contribute to the continent’s economic and social progress. Following the recent launch of 5G networks and the increased fiber networks’ expansion, telcos are expected to increase their use of AI by managing large-scale IoT networks and focusing on smart city projects. The combination of AI and IoT will help support complex use cases like connected vehicles, industrial automation, and smart city infrastructure. The adoption of AI is however hampered in Africa by low broadband penetration rates, lack of technical skills and lack of AI regulatory frameworks.

In terms of markets, Mauritius leads with a focus on governance, while South Africa emphasizes data and infrastructure. Progress includes data protection laws and forthcoming AI strategies, driven by joint efforts from governments, international organizations, and the private sector. Connectivity issues persist, hindering AI development, even in advanced private sectors. The future outlook involves overcoming connectivity challenges, fostering digital literacy, and crafting comprehensive regulations. Key players like Rwanda and South Africa are poised for leadership, with the African Union's role in model legislation and regional collaboration, such as Smart Africa's efforts, holding promise. Investing in digital literacy and sharing best practices can positively shape the sector. As countries address challenges, early-stage regulations and literacy initiatives have the potential to profoundly shape AI development in the years to come.

Next steps

Private-public partnership key to enhance the boost the digital ecosystem

Involving further Governments and regional instiutions is crucial to improve the African digital ecosystmen. While CSPs and other private stakeholders will rmain key players in digital transformation, more governments should be proactive and implement beneficial initiatives. These include imposing that new buildings are fiber ready, stimulating investment in training youth and workers in digital skills and accelerating 5G licensing process. In order to support the digital transformation efforts within its workforce, CSPs need to invest further in cloud, cybersecurity and software development and monitor workforce efficiency regularly and assess that overall productivity and efficiently are growing steadily.

As stakeholders invest strategically in AI, African CSPs should get ready for an increased demand for advanced AI-related services and solutions. However, challenges such as the shortage of AI talent and connectivity issues could pose obstacles to seamless service delivery. Service providers should therefore proactively enhance their capabilities to meet the increasing demand for AI-related services in the region. This involves investing in talent development to address the shortage of AI expertise and improving connectivity infrastructure to overcome potential hindrances. On the regulators’ side, the surge in AI demand and applications introduces complexity to the regulatory landscape. The integration of AI in telecommunications may raise ethical concerns related to data privacy and transparency. Regulators should implement and continuously update ethical guidelines to ensure data privacy and transparency. Regulators should also strengthen monitoring capabilities to cope with technological advancements and regularly assess compliance.

Appendix

Further reading [optional]

Blockchain Technology and Adoption Trends (December 2019)

“Blockchain is good for more than just Bitcoin,” (September 2019)

“CenturyLink goes ‘colorless’ and takes on the edge cloud” (February 2020)

Service Provider Routers & Switches Market Tracker – 4Q19 (February 2020)

Li You, “Tech-savvy Hangzhou tries out new ‘City Brain’,” China Daily (retrieved June 17, 2021)

Author

Name, Job Title, Practice Area

Citation Policy

Request external citation and usage of Omdia research and data via citations@omdia.com.

Omdia Consulting

We hope that this analysis will help you make informed and imaginative business decisions. If you have further requirements, Omdia’s consulting team may be able to help you. For more information about Omdia’s consulting capabilities, please contact us directly at consulting@omdia.com.